Understanding our personal finances has always been important for helping us to manage our savings, especially now with the current difficulties in the economy. Despite this, it’s no secret that the world of finance can be incredibly confusing, often leading to people misunderstanding how they can best grow their personal savings.

To see how much Brits really know about finance, we’ve quizzed 2,000 people across the UK on their knowledge of ISAs, investing and general personal finance. Asking a total of 38 questions, we’ve uncovered where the biggest knowledge gaps are, as well as where the most financially literate individuals reside.

Just over a quarter of Brits passed the money literacy test

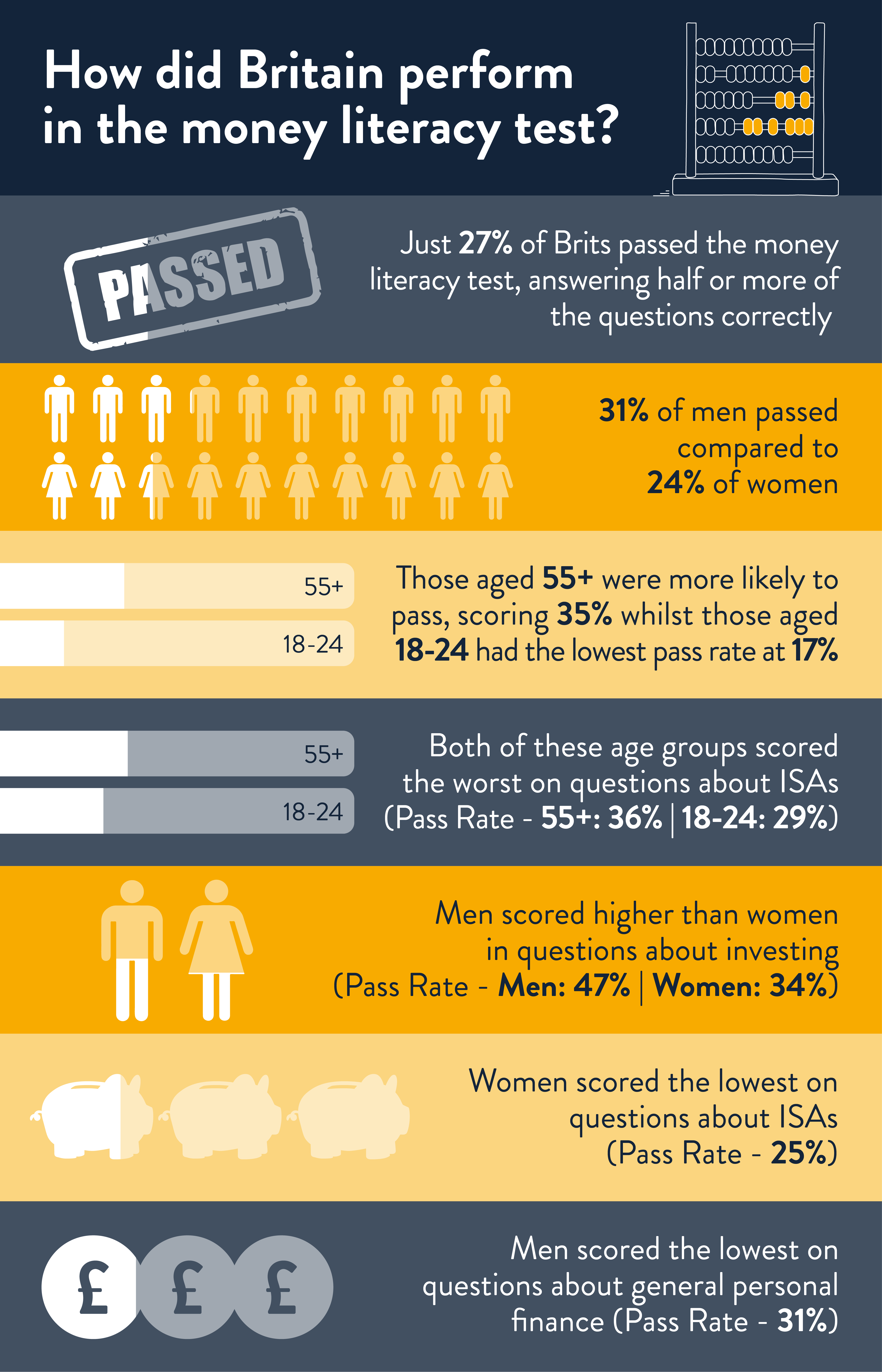

Asking people in the UK a mix of questions on ISAs, investing, and general personal finance, we have found that 73% of people struggle with financial literacy in these areas with just 27% of respondents getting half or more of our questions correct.

Surprisingly, our respondents know more about investing (with 40% passing this section of the quiz, getting half or more of our questions correct) than they do about ISAs and other general personal finance topics. Just 34% of respondents passed our questions on the topic of ISAs, and just 28% passed our questions on general personal finance.

The results also reveal men to be more financially literate than women with 31% of male respondents getting half or more of our questions correct, compared to just 24% of women. Interestingly, both men and women score the highest on questions about investing with 47% of men and 34% of women getting our half or more of questions on this topic right. Meanwhile, both genders score the lowest on questions about general personal finance.

Breaking the results down by generation, those aged 55 and above perform the best on our quiz whilst those aged 18-24 struggle the most. Despite this, both generations score the lowest on questions about general personal finance, with just 19% of 18-24 year olds and 34% of those aged 55+ answering half or more of our questions on this topic correctly.

People from Southampton are the most financially literate in the UK

Our research has found that residents in Southampton are the most financially literate with 38% answering half or more of our questions correctly. Southampton is followed by Cardiff in second place whilst Liverpool comes in third place.

At the other end of the scale, respondents in Glasgow struggled the most with our quiz with just 16% of respondents in this city getting half or more of our quiz questions correct. Glasgow is followed by Sheffield in second place as the city that struggled the most, with Belfast in third place.

When it comes to which city scores the highest across the three different sections of our quiz, Cardiff scores the highest on questions about ISAs (45%) as well as questions on general personal finance (39%), whilst Liverpool scores the highest for questions on investing (49%).

Meanwhile, residents in Edinburgh score the lowest on questions around ISAs (26%) whilst Glaswegians score the lowest on questions about investing (23%) and general personal finance (19%).

Just under a third source information on finances from their bank whilst a quarter get their information from TV

The cost of living crisis has encouraged many of us to revisit the way we spend and save money. However, the amount of information out there on the best ways to manage our finances can be overwhelming.

When asking our respondents where they are sourcing their information from when it comes to their personal finances, we have found that just under a third of people in the UK are using their banks, whilst a quarter are getting information from TV shows.

The top 5 sources for information on personal finance:

| Source of information on personal finances | Percentage of Brits getting information from this source |

|---|---|

| My bank | 29% |

| TV shows (e.g The Martin Lewis Money Show) | 25% |

| 24% | |

| Online articles/forums | 20% |

| The news | 18% |

Perhaps unsurprisingly, the most popular source of information on personal finance topics for those aged 18-24 is TikTok, with more than a quarter (26%) using the popular social media platform to get insight into money related topics.

Meanwhile, the most popular source for those aged 55 and over is TV shows with more than a third (36%) getting information about finances from here, compared to just 14% of 18-24 year olds.

Almost a third don’t know the yearly maximum ISA allowance, whilst more than half think ISA savings are liable to taxation

Despite many of us making changes to our saving habits during the cost of living crisis, it might come as a surprise that almost a third of the people we surveyed are unaware of what the yearly ISA savings limit is. Furthermore, more than half think that their ISA savings are liable to taxation despite one of the top benefits of ISAs being that they allow you to save tax-free.

We also found that more than two thirds of those we quizzed think you have to pay Capital Gains Tax on profits made from a stocks and shares ISA whilst more than three quarters don’t know that you can transfer money from a stocks and shares ISA into a cash ISA.

Surprisingly, two thirds of respondents are also unaware that the government offers a 25% bonus on top of savings paid into a Lifetime ISA, meaning that many Brits could be missing out on the opportunity to grow their savings using this type of ISA.

On top of this, our results reveal that almost two in five are unaware of the start date of the new tax year (which is the 6th of April every year).

Just over a third of Brits are confident in their knowledge of cash ISAs

We also asked people how confident they feel in their knowledge of different types of ISA accounts. Innovative finance is thought to be the most confusing whilst cash ISAs are least confusing:

| Type of ISA | Percentage of Brits confident in their knowledge of this type of ISA |

|---|---|

| Cash ISA | 36% |

| Stocks and shares ISA | 27% |

| Lifetime ISA | 27% |

| Innovative finance ISA | 24% |

Breaking this down by gender, more than a third of men are confident in their knowledge of the four types of ISAs available compared to under a quarter of women. When it comes to the biggest knowledge gap between genders, stocks and shares ISAs are considered to be the most confusing to understand with 35% of men feeling confident in their knowledge of this type of ISA compared to just 18% of women.

Derence Lee, Chief Finance Officer at Shepherds Friendly said “As the majority of the people surveyed lacked confidence in their stocks and shares ISAs knowledge, this indicates individuals potentially aren’t using the most suitable savings vehicle for their needs.

“For example, historic performance indicates that stocks and shares ISAs generally perform better over the medium to long-term than cash ISAs, so those saving for five years or more could benefit from using a stocks and shares ISA over a cash ISA. It’s also a great idea to diversify savings, as this can provide opportunities for growth that exceed inflation.”

Surprisingly, just under a quarter of those aged 18-24 are confident in understanding cash ISAs compared to just under two in five of respondents aged 55+. Meanwhile, just over one in five 18-24 year olds are confident in their knowledge of stocks and shares ISAs compared to over a third of 35-44 year olds.

Just one in three Brits are putting their savings into an ISA account

ISAs allow you to save up to £20,000 tax free each year, meaning they can be a great option for helping you to grow your savings. However, our survey found that just under a third are putting their savings into an ISA (30%), with those aged 18-24 the least likely to do so (24%). Meanwhile, over two fifths (43%) are putting their savings into other types of savings accounts.

With more than a quarter (26%) admitting to keeping their savings in a current account, it can be beneficial to consider how you improve your saving habits. For example, you can get started by looking into which ISA plans are best for your savings goals.

Over half aren’t confident in their knowledge of investing in stocks and shares

Investing has become an increasingly popular way to grow our finances in recent years, with Google searches for “how to buy stocks in a company” skyrocketing by 300% in the UK over the past 12 months.

Despite this, over half (52%) of our respondents agree that they wouldn’t feel confident in investing in stocks and shares with almost one in three (31%) agreeing that they would like to learn more about doing so.

Again, men are more confident in their knowledge of investing with almost two in five (39%) saying they feel knowledgeable in this area compared to a quarter of women. Interestingly, just one in six respondents aged 55 and over feel confident in their knowledge in investing, compared to over half of 25-34 year olds who we discovered are the most confident generation in this area.

Whilst investing can be confusing, opting to save your money into a stocks and shares ISA can be a beneficial way to help you grow your personal finances since any profits will be free from Capital Gains Tax.

Almost a third think they would feel less stressed if they knew how to manage their personal finances properly

The cost of living crisis has pushed many of us to tighten the purse strings, however our survey highlights that over a third of Brits struggle to manage their personal finances since the crisis began. Those aged 25-34 reveal to be the age group struggling the most with this (48%).

Furthermore, over a third of respondents in our survey say that trying to understand their personal finances makes them feel stressed with 25-34 year olds feeling the most pressure (45%) out of all other age groups surveyed. Meanwhile, almost a third of respondents agree that they would feel less stressed if they knew how to manage their finances properly.

Derence Lee, Chief Finance Officer at Shepherds Friendly said “There are a number of ways to manage your money effectively, with budgeting being one of the best methods. You can start by assessing your monthly income and outgoings. From this, define what payments are necessary, which are luxury, and if you can afford to put a set amount of your money into savings on a regular basis.”

“Having a clear overview of your finances means that they are easier to manage and you can focus more on what you need, which is particularly important in the current environment with rising prices. There are a lot of tools out there to help you manage your finances. If you still feel it’s too much for you to get your head around, speak to an independent financial advisor and they will be able to provide qualified financial advice.”

Whilst the world of personal finance can feel hard to navigate, there are many ways you can effectively manage your finances and even grow your savings, with little complication. Here at Shepherds Friendly, we have a range of ISAs available for helping you to make the most out of your savings. Find out more about how we can help you invest.

Methodology

We surveyed 2,003 Brits aged 18 and over in April 2023 on their knowledge of personal finance. The research was conducted between 06/04/2023 and 12/04/2023.

The pass rate of the quiz was calculated by finding the percentage of respondents who got half or more of the quiz questions on ISAs, investing and personal finance correct.